Much like Braintree, Adyen is a full-stack gateway and counts prominent merchants like Microsoft and Spotify as clients. However, merchants must wait two business days for their payments to deposit to an account, and some in higher-risk industries must wait seven business days.Īdyen offers e-commerce companies a payment platform that includes gateway, risk management, and front-end processing services.

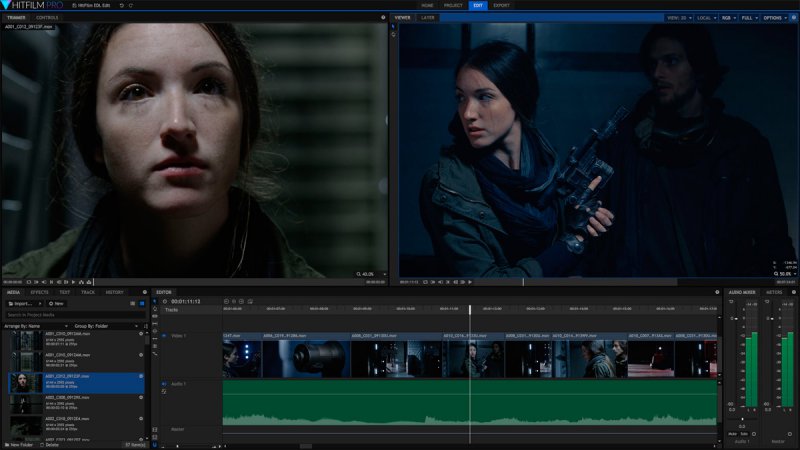

#Hitfilm pro trial update#

Stripe also makes it easy for merchants to update their payment platforms using just a few lines of code.

#Hitfilm pro trial free#

The company offers several free services (such as refunds) for which PayPal charges transaction fees. It provides an API that merchants and web developers can use to integrate payment processing into their websites. Stripe has become the world’s sixth largest unicorn at a $35.3 billion valuation. The firm had an estimated 6 billion processed transactions in 2018, and much of that success stems from its strategic focus on mobile, a high-growth commerce channel. Braintree provides developers with an SDK with multiple features. Braintree has secured the business of some of the world’s largest digital merchants, such as Uber and Airbnb. This PayPal-owned gateway supports payments for mobile-centric merchants, and it benefits from its access to the millions of PayPal sellers. Like what you’re reading? Click here to learn more about Insider Intelligence’s leading Financial Services research. One disadvantage, though, is that the gateway helps Amazon strengthen its brand, which many e-commerce merchants must compete against. Furthermore, it has expanded by offering its platform to other merchant sites – an attractive proposition for third-party merchants. Amazon PaymentsĪmazon’s proprietary credit card payment processor supports payments on its parent’s website, which gives it instantaneous access to high payment volume. Today, the company offers payment solutions across in-store, online, and mobile channels. Ingenico is a legacy payments processor that initially stood out as a top provider by handling in-store card payments – and thus is popular among companies where in-store payments is a top priority. 1 acquirer by purchase transactions in the US. In 2018 Worldpay was acquired by US rival Vantiv, and the combined entity was later purchased by US financial services company FIS in 2019. The company provides several payment services for both online and in-store channels, and in 2018 was deemed the No. UK-based Worldpay is one of the longest-tenured online payment platforms. Keep in mind that no one company or gateway has an overwhelming share of the market, and competition among these companies remains strong. Which payments gateway provider should you use? What are the inherent advantages and disadvantages of each?īelow, we’ve compiled a list of the industry’s leading payment companies to help you decide. But as more companies pour into this space, it will create difficult decisions for merchants.

Given this, it’s understandable that more gateways will want to get a piece of the pie. In the US, e-commerce sales totaled $146.2 billion in Q2 2019, making e-commerce nearly 11% of retail overall. Insider Intelligence expects that as global retail e-commerce volume continues to rise, revenue the companies processing these payments can collect as fees will increase from $82 billion in 2018 to $138 billion in 2024.įurthermore, payment companies, merchant acounts, and consumers are all shifting to digital, which is giving gateways more influence. They often sell bundled services that include payment acceptance, data reporting, and fraud management. The best payment gateways serve as the online version of a payment terminal and front-end processor for online and mobile sellers. Payment gateways are the first step in the online payment process, and they have been crucial in helping e-commerce companies and online payment providers more easily accept online transactions. Do you work in the Financial Services industry? Get business insights on the latest tech innovations, market trends, and your competitors with data-driven research.Insider Intelligence expects revenue the online payments providers can collect as fees will increase from $82 billion in 2018 to $138 billion in 2024.Payment gateways are the first step in the online payment process, and they have been crucial in helping e-commerce companies more easily accept online transactions.

0 kommentar(er)

0 kommentar(er)